5 Good Accounting Software That Every Small Business Should Have

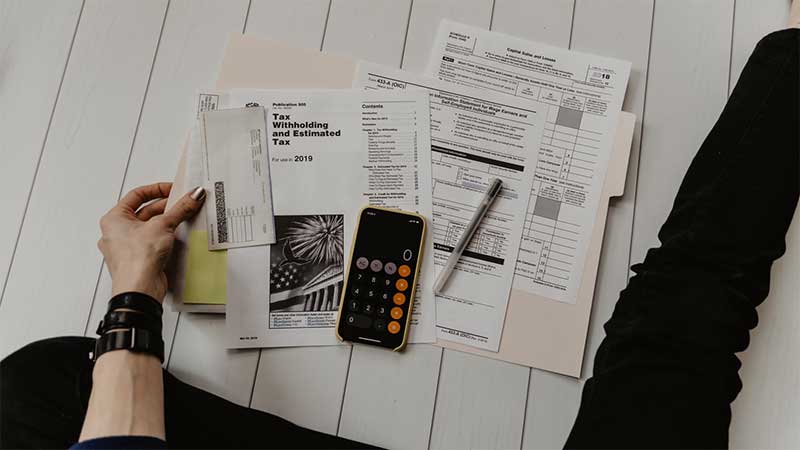

Once your business starts growing, you start handling bigger projects and high-end clients, and it requires an accurate and trustable process. You can’t rely on manual paperwork, invoicing, and bookkeeping anymore.

You need to adapt to a seamless process for all your accounting requirements. The best way to implement it is by getting online accounting software. It helps you streamline all your transactions, takes care of all the transactions, provides easy tracking of finances, reduces roots, among other benefits listed below.

Now, more and more companies have implemented accounting software in their company as it provides numerous benefits and supports growth. So, in this article, I have listed down the best online accounting software that can be adapted by any kind of business.

Also Read: ERP Software and Its Benefits

List of the Best Accounting Software

FreshBooks

FreshBooks is an all-in-one accounting software that is easy to use and offers powerful features. It is cloud-based accounting software that’s perfect for any type of business. The reason why I added FreshBooks to the list is that it doesn’t require advanced knowledge of accounting to operate it.

If you are familiar with the accounting basics, you can use this software without any hassle. Businesses from over 160 countries are using FreshBooks as it helps the company in every stage of their process.

Key Features of FreshBooks

- Creation of professional invoices within minutes.

- Track and manage all your expenses right inside FreshBooks.

- Keep other team members in the loop by collaborating on projects and sharing files, conversations, and feedback.

- You can set up payment reminders.

- Track time and log hours into FreshBooks for easy invoicing.

- Get paid faster with online credit card payment options.

- Make informed decisions with the help of insightful accounting reports.

- They also offer Accounting Templates

QuickBooks

QuickBooks is a renowned accounting software developed by Intuit that offers various solutions for your accounting requirements. QuickBooks is a versatile software, providing both cloud-based and desktop options for its users.

In fact, over seven million businesses use QuickBooks currently. It enables you to streamline your transactions and finances and is fairly easy to set up.

Key Features of QuickBooks

- Invoicing, managing bills, cashflows, tracking expenses, bill management, income and expenses, project profitability, etc.

- Sorting tax and expenses into respective categories automatically.

- Enables customized reports with the help of cash flow tracking

- Offers time tracking option for better time management.

- Integrates with PayPal, Shopify, and Square for seamless exchange of invoices and payments.

Wave Financial

Wave is an accounting software based in Canada that provides financial services. This accounting software enables you to manage all your expenses and income and helps you connect with other Wave products such as payroll, payments, and invoicing. Wave provides free accounting and invoicing services for its users.

Although, payroll services and credit card processing services are included in paid plans. Wave is an ideal software for start-ups and small businesses that are looking for easy accounting solutions.

Key Features of Wave

- Sales tax tracking on income and expenses.

- Accessible to multiple users.

- Follows double-entry system.

- Unlimited income and expense tracking.

- Provides reports including cash flow and profit and loss statements.

Xero

Xero is a cloud-based software for small and growing businesses. It is packed with robust features that help you accept payments, capture data effortlessly, pay bills, and claim expenses.

This accounting software is easy to set up and doesn’t require any prior accounting knowledge, hence it has grown popular among many growing businesses since it was founded back in 2006. Xero provides many excellent features like project tracking, capturing bills and receipts, and managing costs. Moreover, its two-step authentication keeps your data secured.

Key features of Xero

- Sending invoices.

- Quick bank reconciliation.

- Easily create expense claims.

- Financial reports that keep you updated.

- Keeps data protected.

- Track projects.

- Use Hub doc to capture data

Zoho

Zoho is online accounting software that enables you to organize all your finances in one place. Zoho helps you to create invoices, track your finances, and lets you collaborate with your accountant or team.

Moreover, it also offers automation for sending recurring payment invoices, setting reminders for receiving payments, categorizing, and auto-charging cards for recurring transactions. You don’t need to possess any accounting knowledge before using this software so it’s easy to use and set up.

Key Features of Zoho

- Automating payments.

- Reconciling bank transactions.

- Invoicing.

- Audit reports and tax compliance.

- Automatic tax calculations.

Final Thoughts

Every business has distinctive requirements when it comes to handling transactions, so you need to determine what exactly you’re looking for when selecting accounting software. Businesses have evolved over the years, resulting in more options, so in this article.

I have narrowed it down to 5 good online accounting software that you can consider if you want to adapt to cloud-based accounting. So, go through the software listed above and pick the one that fits right with your company’s needs.

Share