Guide for Mortgage Brokers in Texas: Navigating Favorable Mortgage Rates in the Lone Star State

Introduction

In the expansive and diverse landscape of Texas real estate, securing the right mortgage is both challenging and significant.

Brokers of this place are armed with local knowledge and expertise and play a vital role in this endeavor.

This comprehensive guide explores how the Texas brokers facilitate obtaining low mortgage rates and maneuver through the distinctive housing market.

The Role of a Texas Mortgage Broker

Defining a Mortgage Broker

Acting as intermediaries between borrowers and lenders, mortgage brokers seek the best rates and terms tailored to the borrower’s needs.

The real estate market in Texas spans bustling urban hubs to tranquil rural areas. Therefore, a property dealer’s intimate familiarity with the local market proves invaluable.

Reasons to Opt for a Texas Mortgage Broker

- Insight into the Local Market: Mortgage brokers possess an in-depth understanding of the state’s diverse real estate landscape.

- Access to Multiple Lenders: Collaboration with various lenders can result in more favorable deals and terms for borrowers.

- Personalized Service: Property dealers offer tailored solutions based on the borrower’s financial situation and property goals.

THINGS TO CONSIDER

There are plenty of lenders that only make home loans through local brokers. Having a local property expert gives you an edge over those who try to find funding on their own.

The Process of Engaging with a Texas Mortgage Broker

Initial Consultation

The journey typically commences with a consultation where the property expert evaluates your financial situation, discusses property aspirations, and outlines the lending process.

Securing Competitive Rates

Brokers utilize their extensive network of lenders to Get low mortgage rates in Texas for their clients, by comparing prices from various sources, ensuring a competitive offer.

Application and Approval

Property dealers assist with the contract application, guide through necessary documentation, and liaise with lenders, streamlining the approval process.

Closing the Deal

Upon securing the best property offer, your intermediary will guide you through the closing process, ensuring accurate handling of all paperwork.

Advantages of Employing a Texas Mortgage Broker

Savings on Mortgage Rates

A key benefit of using a broker is the potential for lower contract rates due to their relationships with multiple lenders.

Time and Stress Reduction

Navigating the contract landscape can be time-consuming and stressful, property dealers alleviate this burden, making the process smoother and more efficient.

Expert Guidance

Brokers provide expert advice on contract products and the home buying process, particularly beneficial for first-time buyers.

Understanding Texas Real Estate Market

Market Diversity

Texas’ real estate market is highly diverse, with variations in property types, prices, and trade dynamics across regions.

A local broker’s expertise in understanding the changing trends is significant.

Growth and Opportunity

The state’s thriving economy and population growth present challenges and opportunities in the real estate market.

Property experts offer valuable insights into the trade trends and investment potential.

Navigating Mortgage Types in Texas

Conventional Loans

Standard loans not insured by the federal government, property agents can secure competitive costs based on creditworthiness and down payment.

Government-Insured Loans

FHA, VA, and USDA loans offer benefits such as lower down payments or no down payment options; agents assist in determining eligibility and guiding through the application process.

Non-Conforming Loans

For properties or borrowers not fitting conventional loan criteria, non-conforming loans are an option, property traders navigate these more complex loan types.

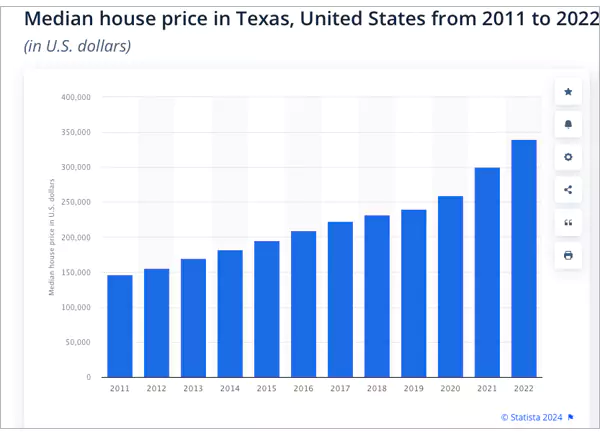

The graph below shows the median house prices in Texas, United States from 2011 to 2022.

Tips for Collaborating with a Texas Mortgage Broker

Choose the Right Broker

Opt for a licensed and seasoned broker with a proven track record and favorable client reviews, personal recommendations can also be highly beneficial.

Understand Fees and Costs

Clarify the property dealer’s fees and any other costs associated with securing a mortgage.

Communication is Key

Maintain transparent and regular communication with your broker, who will provide continuous updates throughout the entire process.

Success Stories

Case Studies:

- A first-time buyer in Austin secured a competitive rate for a conventional loan through a broker, despite a challenging market.

- A family relocating to Houston utilized a broker to secure a VA loan, navigating the complex process smoothly.

Conclusion

A Texas mortgage broker serves as an invaluable asset in your home-buying journey.

Not only does he aid in obtaining low mortgage rates but also offers guidance, trade insight, and personalized service.

When purchasing your first home, investing in property, or relocating, a broker can make the process more manageable and successful.

In the dynamic and diverse Texas real estate market, ensure you search for the best possible mortgage for your dream home in the Lone Star State.

Share