Annuities Through the Ages: A Journey of Growth and Transformation

Annuities have been with us since ancient times.

Today, they are one of the most productive financial tools that one simply cannot live without.

If we look into the history of annuities, we can see some gradual growth and transformation that has shaped them into what we see in the present financial landscape.

The enduring nature of annuities simply underscores their resilience and effectiveness in giving us financial security and stability across many different economic environments.

If you want to learn more about annuities, you can simply visit annuityrateshq.com.

From their humble beginnings as simple arrangements in ancient civilizations to the sophisticated financial products of today, annuities have continuously adapted to meet the changing needs of investors.

So, What are Annuities Exactly?

They are like an insurance contract given and distributed by many financial institutions.

They are created to pay out your invested funds in a fixed income stream in your golden years.

You can get started with buying annuities on a monthly premium or in lump sum payments from any financial institution or insurance company.

The holding institution then issues a stream of payments in the future for a specified period or for the remainder of your life.

Annuities are mainly used for retirement purposes and help individuals address the risk of outliving their savings.

DID YOU KNOW?

Some annuities have NO fees. That’s 0%. It doesn’t get much lower than that. And, the average annual fees on a variable annuity are 2.3%. In general, the simpler the annuity, the lower the fees.

Ancient Origins

The roots of annuities can be traced back to ancient civilizations, where they were used to provide old or injured soldiers with financial security and stability.

In ancient Rome, for example, the government offered annuities to veterans and public servants as a form of pension, ensuring a steady income during retirement.

Medieval Development

In the Middle Ages, annuities saw an increase in popularity to make up for some pretty huge changes, which included infrastructure construction and military expeditions.

Many nobles and monarchs often used to issue annuities to raise funds, promising regular payments in return for lump-sum investments.

Rise of Modern Annuities

The main concept for today’s modern annuities began in the early 17th century with the establishment of the first annuity contracts in England.

These contracts pretty much laid the foundation for what we see today by offering individuals a lump sum payment in exchange for a guaranteed lifetime income.

Industrial Revolution and Expansion

You know, the Industrial Revolution saw a pretty huge change in how annuities were operated.

Driven by the advancements in industry and commerce, the wealth accumulation capacity grew, which in turn meant that there was a growing demand for a better way of retirement planning that could guarantee the way of life of the workers when they reached retirement age.

Insurance companies began offering annuity products to the general public, providing a reliable source of income for retirees.

Regulatory Framework

The creation and development framework for annuities came much later in the early 20th century.

This meant that consumers could now be protected from losing their money and the companies that offered annuities had to guarantee at least a percentage of returns in case they lost their customers’ hard earned money.

Government agencies also introduced some guidelines and standards for annuity products, imposing strict regulations on insurance companies and financial institutions.

Modern Innovations

Over the past couple of decades, annuities have continued to evolve and grow by adapting to the changing demands of investors.

Today, you can see many different kinds of annuities being offered by these companies.

Variable annuities, indexed annuities, and other specialized products have emerged, offering investors diverse options for income generation and wealth preservation.

The Productivity of Annuities

Annuities are among the most productive financial tools available to investors today, offering a unique combination of benefits that make them well-suited for retirement planning and income generation.

Some key factors contributing to the productivity of annuities include the following:

Guaranteed Income

This means that investors can rest assured that their financial stream after retirement is pretty much guaranteed for a fixed period or at least until they die.

Whichever event takes place first.

Tax Advantages

Many of the annuities offered today come with tax-deferred growth.

This allows the investments to grow without being subject to any annual tax.

This maximizes the potential returns one can get from them.

Protection Against Market Volatility

Fixed annuities protect investors from market volatility by offering a guaranteed rate of return, ensuring stable growth and income regardless of economic conditions.

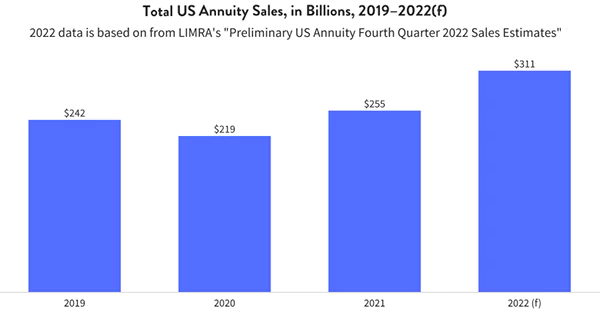

Annuity sales in the U.S. in 2022 totaled $310.6 billion, according to the Life Insurance Marketing and Research Association. That’s a 22% increase from the 2021 sales of $254.9 billion. Sales for variable annuities were at $102.6 billion, while fixed-annuity sales numbers reached $208 billion. Previously, a look at annuity statistics shows that 2008 had the highest record at $265 billion. That’s almost 17% lower than the new record set in 2022.

Conclusion

The journey of annuities through the ages is a testament to their resilience, adaptability, and enduring value as a financial instrument.

From their humble ancient origins to modern innovations, annuities have evolved to meet the diverse needs of investors, providing a reliable source of income and economic security for generations to come.

Annuities remain a cornerstone of retirement planning and wealth preservation strategies as they evolve.

With their ability to offer guaranteed income, tax advantages, and protection against market volatility, annuities are poised to play a vital role in securing financial futures for individuals and families worldwide.

Share