Trust Deed Investing 101: Essential Insights for Every Investor

Suppose, investing in a property without having to own, repair, or maintain it. Trust deed investment can be an effective and secure way to diversify your portfolio and generate potentially attractive returns. It can be one of the highest rewarding ways to invest, however, it is significant to look at several aspects related to it.

That’s why, in this all-inclusive guide, we’ll explore all the fundamentals of trust deed investing, offering vital insights that every newbie or seasoned investor should know. Besides, we’ll take a look at the role of reputable firms like LBC Capital Inc. in facilitating the process.

Understanding Trust Deed Investing

To simplify, it is a type of agreement used generally in real estate transactions. It involves lending money to the borrower secured by real estate properties. Investors here hold a secure interest in the property through a trust deed or mortgage.

This type of investment not only offers higher returns but also provides a level of security backed by tangible capital. In such cases, the trader doesn’t have to purchase any property, instead, they lend their money to investors looking for property financing. Moreover, integrating financial reporting automation streamlines processes, ensuring accurate and timely reporting, thereby enhancing transparency and efficiency in investment management.

In return, the borrower pays the lender a decent amount of interest till the time the complete loan amount is repaid.

Key Components of Trust Deed Investing

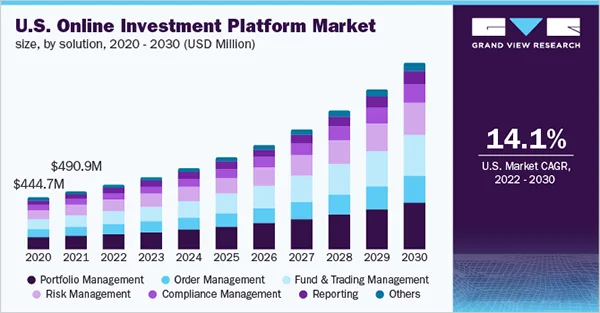

(This graph shows the US online investment platform market by size and solution, in 2020-2021, at US$ billion).

In this section, we’ll decode the key components involved in the trust deed investment.

- Borrower and Property: This investment type needs a debtor who pledges a real estate property as collateral for the loan. The property acts as a medium of security for the investment.

- Loan Terms: The loan term document includes several things such as principal amount, interest rate, and repayment schedule. They are outlined in the agreement.

- Secured Interest: The lender holds a secured interest in the property, generally recorded against the property title. This ensures that the investor has a legal claim to the property in case of bankruptcy.

- Passive Income: These investors earn regular interest payments from their borrowers, providing a reliable source of passive income.

Benefits of Trust Deed Investing

Trust deed agreement benefits investors in so many ways. Let’s explore what it offers.

- Predictable Returns: This type of investment ensures a certain amount of return as interest from borrowers, offering lenders a stable income stream.

- Asset-Backed Security: These investments are backed by tangible real estate assets, minimizing the risk of bankruptcy and potential losses for the financier.

- Portfolio Diversification: Including this type of investment in a portfolio can help differentiate risk and enhance overall portfolio stability.

- Potential for High Yields: It harvests higher returns, especially in an environment of low-interest rates and upsurging real estate values.

Disadvantages of Trust Deed Investing

While having several pros, trust deed investment has some consequences as well, that are worth considering, being an investor.

- No Liquidity: Unlike stocks or other forms of investment, property investments are not liquid, which means lenders cannot recover their money on demand.

- No Capital Appreciation: There’s no capital appreciation an investor can expect from this type of investment, the only source of earning is interest amount.

- Legal Risks: In many cases, invested parties may manipulate any legal errors, leading to expensive legal complications. In such cases, a new lender, with no expertise or experience may face difficulties.

The Role of LBC Capital Inc. in Trust Deed Investing

As a trusted financial partner, LBC Capital Inc. specializes in simplifying investments, providing financiers access to fruitful opportunities and personalized guidance to boost returns. Keep reading to know what more they offer:

- Expertise and Experience: They have a team of seasoned professionals with considerable experience in property finance and investment management.

- Rigorous Due Diligence: They manage thorough due diligence on all potential investments, ensuring ordering with investors’ goals and risk profiles.

- Transparent Communication: They manage open and transparent communication with lenders, offering regular updates and insights on the performance of their investments.

- Tailored Solutions: They offer custom-based solutions tailored to meet the specific requirements of individual traders.

Do You Know?

The USA has the largest share of total world equity at 55.9% which is significantly larger than the share of the next leading countries Japan, the Republic of China, the UK, and France combined, equivalent to just 19.8%.

Conclusion

Trust deed investment offers traders a fascinating chance to diversify their portfolios, earn passive income, and likely achieve fair returns. Integrating reputable firms like LBC Capital Inc., to your investing strategies can unlock the potential for long-term financial success.

Share