Kagi Chart: What It Is, How It Works, and When You Should Use It

In this increasingly digital age, various innovative tools have been designed to help improve trading strategies. One such tool is the Kagi chart. Used extensively by traders, this article will delve into what it is, how it works, and when to use it for the best exchange results. Keep reading to learn more.

Understanding Kagi Chart Basics

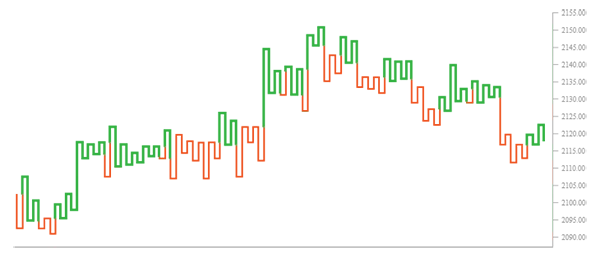

To begin with, let’s understand what a Kagi chart is. It is a visualization used to track the cost movements of a security. Its key feature is eliminating time factors, focusing solely on value shifts.

Interesting Fact: It is one of the specialized types of technical analysis developed in Japan in the 1870s.

Unlike traditional bar or line charts, it consists of a series of vertical lines representing price movements. These lines oscillate around a horizontal line known as the ‘Kagi line.’

Its distinctiveness lies in the concept of “reversal amount.” This is a predetermined shift that must be exceeded for the chart to reverse its direction. This concept differentiates them from others, as time, volume, or other factors do not influence their structure.

The Mechanism Behind Kagi Charts

The functioning of a Kagi chart is straightforward, even though it may appear complex at first glance. The chart is dependent on two significant aspects: price action and a preset reversal amount.

The preset reversal amount is set by the trader and signifies the minimum cost change required to shift the line. This helps filter out minor fluctuations and reduces noise in the price data.

It’s vital to remember that they are not time-based, which means they do not form new charge bars at regular time intervals. Instead, new bars are formed only when prices move a certain amount in either direction.

Thus, they offer a more precise visual representation of the ‘pure’ cost action, making them a valuable tool for traders assessing market trends.

Interpreting Kagi Chart Signals for Trading Success

Interpreting the signals provided by it enables traders to predict future price movements and execute profitable trades. It provides three primary types of signals: bullish signals, bearish signals, and consolidation signals.

A bullish signal occurs when the line shifts from thin to thick, indicating a shift in industry sentiment toward buying. Conversely, a bearish signal is suggested when the line shifts from thick to thin, implying increasing market pessimism.

Did You Know?: What does Kagi stand for? Well, the word “Kagi” means “Key” in Japanese.

Consolidation signals, reflected by horizontal lines, suggest periods of cost equilibrium where buying and selling pressures are in balance. These can be precursors to major movements, providing traders with important insights.

Appropriate interpretation and response to these signals can significantly enhance exchange success.

Benefits of Using Kagi Charts in Market Analysis

It offers a range of benefits that make them an integral part of any trader’s toolkit. Firstly, by eliminating the time factor, these charts allow traders to focus solely on cost actions, rendering a clutter-free perspective of industry trends.

Moreover, such charts are effective in identifying support and resistance levels, often more accurately than conventional bar or line charts. This is because they reduce price noise by filtering minor fluctuations.

Also, it provides clear signals of significant trend reversals, helping traders identify profitable entry and exit points. This can equip traders with actionable insights and enhance their decision-making process.

Last but not least, they are versatile and can be used for any trading instrument and in any market, adding to their popularity among traders.

Practical Scenarios: Optimal Situation to Utilize Kagi Charts

They are especially useful in certain trading situations. For example, when a market trend is not clear using traditional charts, it can assist in identifying the underlying momentum and trend direction.

Also, in the absence of time data organization, they can offer a better depiction of the industry’s supply and demand dynamics. This makes them an effective choice for longer-term investment decisions.

Moreover, during high-volatility periods, where expense variations are wide and quick, they can help sieve out the actual cost changes for lucrative commerce.

However, despite their benefits, like any other system, they should not be used in isolation. They are best utilized alongside other analysis tools and money management strategies.

Kagi charts serve as a powerful tool in a stock trader’s arsenal, empowering traders with a visual representation of significant cost movements. By providing a clear, noise-free perspective of the trends, they enable better decision-making and maximize the opportunities for profitable commerce.

Share